With Dire Earnings Results, How Could the Stock Market Go Higher?

If you want to know where the stock market is headed, there are a few factors you must consider. One of the most important factors is business earnings. The stock market moves up and down based on earnings. If earnings are down and are expected to go down further, the stock market will drop.

Earnings over the past few quarters have been anything but good. The fourth quarter of 2022 and the first quarter of 2023 were equally bad.

For the second quarter of 2023, the earnings by S&P 500 companies are estimated to have dropped by seven percent. Assuming this ends up being the final figure, it will be the biggest decline in earnings by S&P 500 companies since the second quarter of 2020. It will also mark their third consecutive decline. (Source: “Earnings Insights,” FactSet Research Systems Inc. July 21, 2023.)

We’re in the midst of earnings season for the second quarter of 2023. As of July 21, roughly 20% of the S&P 500 companies reported their earnings. Overall, those companies reported a decline of nine percent in their bottom line.

Business Earnings Could Get a Lot Worse

For the third quarter of 2023, analysts are projecting that S&P 500 companies will report earnings growth of just 0.1%.

In February, analysts were expecting S&P 500 companies to report third-quarter earnings growth of 3.3%. In early April 2023, those analysts were forecasting that S&P 500 companies would report third-quarter earnings growth of 2.1%. (Source: “Earnings Insights,” FactSet Research Systems Inc., April 6, 2023.)

In June, the expectation was for third-quarter earnings growth of 0.9%. (Source: “Earnings Insights,” FactSet Research Systems Inc., June 1, 2023.)

Will analysts’ earnings expectations drop further? Will they start expecting an earnings decline in the third quarter? It’s possible.

But don’t get too fixated on the numbers projected for the third quarter; look beyond them.

Economic conditions are worsening, not just in the U.S., but globally. There’s a significant amount of data that suggests an economic slowdown is fast approaching, if not here already. How can earnings be robust if the economy is slowing down?

Also, don’t forget that interest rates have been going up across the board. As interest rates go higher, credit starts getting affected. Credit has already been tightening. This could really hurt companies’ ability to expand their operations, and it increases the odds of a financial crisis. That’s a big risk to earnings.

Stock Market Soars; Investors Want to Buy More Shares

After reading everything I’ve just mentioned, if I were to ask you how the stock market has been performing and how it could look in the future (assuming you haven’t been following the key stock indices), it’s very likely you’d say the stock market’s performance must be abysmal, and that it could drop a lot.

That certainly hasn’t been the case. Stock indices have been soaring, and investors want to buy more shares.

Take a look at the following S&P 500 price chart. This index has soared by about 19% year-to-date. So, in just a few months, the S&P 500 has provided more returns than the overall stock market.

The long-term average returns from the S&P 500 are about eight percent to 10%.

Chart courtesy of StockCharts.com

Investors aren’t nervous these days. Just look at the Chicago Board Options Exchange (CBOE) Volatility Index (VIX) chart below.

The VIX is often referred to as the “fear index.” When it’s trading below 20, it’s a sign that investors are becoming optimistic and are happy to own stocks. Currently, investors are saying they love stocks.

Chart courtesy of StockCharts.com

Investors Becoming Euphoric

You know what’s even more interesting (and troubling)? Investor sentiment is extremely bullish at the moment.

Consider the percentage of bullish responses to the American Association of Individual Investors (AAII) Sentiment Survey. On a weekly basis, this survey asks individual investors where they see the stock market going in the next six months. In its most recent reading, 51.4% of all respondents were bullish. (Source: “The AAII Investor Sentiment Survey,” American Association of Individual Investors, last accessed July 24, 2023.)

How significant is the 51.4% figure? It’s the highest this percentage has been since early 2021. Furthermore, the historical average of bullish responses to the AAII Sentiment Survey is about 37.5%.

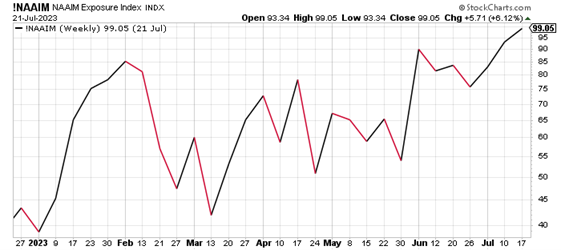

Look at another chart below. This one plots the National Association of Active Investment Managers (NAAIM) Exposure Index.

This index shows what portion of active investment managers’ portfolios consists of stocks. When the NAAIM Exposure Index is at 100, it means active money managers are fully invested in stocks. When the index is over 100, it means active money managers are leveraged long on stocks.

Active money managers have been loading up on stocks in 2023. Early in the year, their portfolios consisted of roughly 40% stocks. Now, their portfolios are close to being fully invested in stocks.

Chart courtesy of StockCharts.com

Irrationality Prevails, Which Won’t End Well

Keeping everything in mind, I must ask this: Have investors lost their minds?

It seems that stock traders haven’t been really paying attention to the fundamentals. There’s a storm brewing, but investors refuse to acknowledge that. Irrationality prevails.

The irrationality can go on for a while, but not forever. When traders start paying attention to the fundamentals, it might not be a pretty sight. The higher the stock market indices go, the worse the downside could be. Irrationality has always eventually resulted in a mass exodus. It takes time, though.

Therefore, investors shouldn’t get complacent. It certainly looks like there could be more upside in the near term as investors remain bullish and continue to not really care about fundamentals.

Now could be a good time to place stops on your existing positions. This could help you lock in gains in case there’s a sell-off. It also might not be a bad idea to take some profits into the rally and raise some cash for your portfolio. Extra cash could be useful when stock indices are down and many investors are fleeing. You could find great opportunities then.